What’s the Difference Between Business Software and Physical Bookkeeping?

Last Updated on 23 December, 2025

Business software is faster, more accurate, and scalable, while physical bookkeeping is manual, time-consuming, and prone to errors.

As a wellness business owner, choosing between the two isn’t just a matter of preference; it directly impacts how efficiently you run your operations. While paper records and spreadsheets might get you by for a while, they often lead to delays, mistakes, and limited visibility.

In this post, we’ll break down the key differences between business software and physical bookkeeping and explain why more wellness businesses are going digital.

Key Takeaways: Business Software vs. Physical Bookkeeping

- Business software improves speed, accuracy, and decision-making

- Physical bookkeeping creates delays and lacks visibility

- Digital tools scale with your business and reduce manual tasks

- WellnessLiving offers an all-in-one solution to streamline finances, scheduling, and growth

What’s the difference between business software and physical bookkeeping?

Business software automates financial tracking, reduces errors, and integrates with scheduling, payments, and reporting, making it faster and more scalable than physical bookkeeping. In contrast, physical bookkeeping relies on manual data entry, paper records, and limited access, which can slow operations and increase the risk of mistakes.

How business software works

Automated financial tracking

With business software, every transaction, from payments to refunds, is logged instantly. Instead of manually entering receipts or updating spreadsheets, you get real-time visibility into your business’s financial health.

This automation helps reduce errors, flag discrepancies early, and speed up time-consuming processes like reconciling accounts or preparing for tax season. And because everything’s tracked in one place, it’s easier to answer questions like “How did we perform this month?” or “Which service is generating the most revenue?”

Integrated features for operations

Managing your finances is just one piece of the puzzle. Most modern business software also handles the day-to-day operations that keep things running, like bookings, billing, and client communication.

You’ll typically find:

- Scheduling: Sync class calendars, instructor availability, and client bookings.

- Payment processing: Automate recurring billing, in-app purchases, and mobile wallet support.

- Marketing tools: Send targeted emails or SMS campaigns, promote events, and track engagement.

For wellness studios, that kind of all-in-one integration streamlines everything from class enrollment to revenue tracking, all without hopping between apps.

How physical bookkeeping works

Manual record-keeping

Physical bookkeeping (whether it’s pen and paper, printed invoices, or Excel) requires hands-on input for everything. That includes logging payments, categorizing expenses, filing receipts, and updating ledgers.

This process takes time, and mistakes often go unnoticed until they cause a problem. Worse, data can easily be lost or duplicated. It’s a system that works… until it doesn’t.

Limited accessibility

Paper records stay where they are (usually in your studio or office). Want to check yesterday’s cash flow from your living room? You can’t.

Limited accessibility means:

- Missing insights when you’re away from the studio.

- Relying on manual copies for your accountant or bookkeeper.

- Delayed responses to questions from team members or financial advisors.

Cloud-based business software removes those restrictions.

Why businesses choose software over paper

Greater accuracy and efficiency

Automation drastically cuts down on human error. You’re not mistyping figures or forgetting to log a purchase, and that translates to smoother tax prep, fewer billing headaches, and more reliable reports.

According to an AP Metrics That Matter report by Ardent Partners, businesses using AI-powered automation process invoices 81% faster and reduce costs by nearly 80% compared to manual methods.

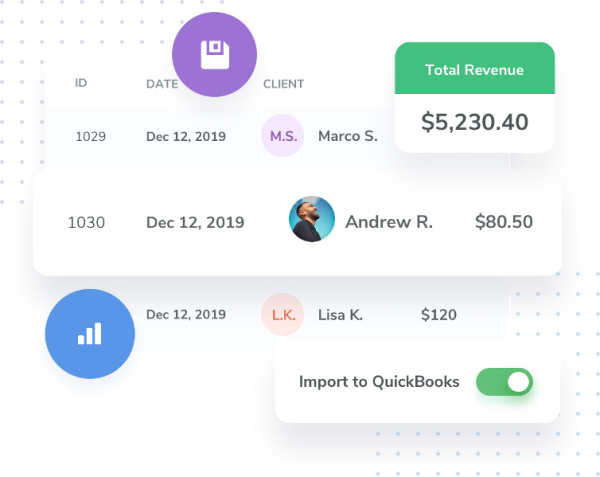

While not every platform uses advanced AI, tools like WellnessLiving already offer intelligent automation—such as daily transaction syncing with QuickBooks and workflow integrations via Zapier—that significantly streamline financial management and reduce manual bookkeeping errors.

That kind of efficiency lets you spend less time managing your books and more time actually growing your business. Learn more about why your business needs an integration plan in this article.

Scalability and growth

Here’s where business software truly outpaces paper systems: growth. When your business is small, a manual process might be manageable. But when you add new services, locations, staff, or clients, the cracks start to show.

You need systems that adapt with you. Business software helps you:

- Track performance across multiple locations

- Standardize staff workflows

- Monitor trends and seasonality

- Forecast more accurately

Paper can’t offer that. Not without a lot of copying, emailing, and late-night reconciliations.

How WellnessLiving supports your business

WellnessLiving was built for the complexities of running a wellness business, especially those looking to move beyond manual tracking. Instead of separate tools for finances, marketing, and scheduling, it offers one platform that handles it all.

“Being able to integrate the accounting, the database, and an app into one piece of software that all works together is what our business has been lacking. This will help us keep better track of clients and will make the client experience more seamless.” — Kat D. (G2 review)

With WellnessLiving, you can:

- Track income, memberships, and expenses automatically

- Let clients book, reschedule, and pay online

- Create custom reports to see exactly how your business is doing

- Automate emails, loyalty programs, and promotions

And because it’s all cloud-based, you can do it from anywhere.

For a deeper dive, you can check out this tutorial video on our finance features and integration with QuickBooks:

Ready to simplify your bookkeeping?

If you’re still spending hours tracking payments, updating spreadsheets, or chasing down invoices, it’s time to upgrade. WellnessLiving’s all-in-one software streamlines your finances, syncs with QuickBooks, and helps you run a smoother, more scalable business.

👉 Book a free demo to see how it works in action.

FAQs about business software vs. physical bookkeeping

Yes. Most modern business platforms (like WellnessLiving) do far more than bookkeeping. They often include built-in tools for class scheduling, client management, automated billing, marketing, and even loyalty programs—so you’re managing your entire operation, not just your numbers.

You can absolutely switch mid-year. Most software platforms let you import past records, upload spreadsheets, or integrate with accounting tools like QuickBooks. It might take a bit of cleanup at the start, but once it’s set up, your financial workflow becomes much easier to manage.

Software doesn’t replace an accountant, but it makes their job (and yours) a lot easier. With everything logged, categorized, and report-ready, your accountant spends less time hunting down receipts and more time helping you make strategic decisions.

Software automates invoicing, payment tracking, reporting, and data entry. This eliminates manual paperwork, reduces errors, and frees up time for higher-value tasks.

Yes. Small businesses gain better organization, real-time visibility, and scalability. Software helps owners save time, stay compliant, and make informed decisions without hiring extra staff. WellnessLiving helps small buisiness like yours get the tools to compete with nationwide chains.